6 Easy Facts About Insurance Agency In Dallas Tx Shown

Wiki Article

Unknown Facts About Home Insurance In Dallas Tx

Table of ContentsHow Health Insurance In Dallas Tx can Save You Time, Stress, and Money.All about Commercial Insurance In Dallas TxWhat Does Commercial Insurance In Dallas Tx Do?Our Commercial Insurance In Dallas Tx StatementsSome Known Questions About Life Insurance In Dallas Tx.

The costs is the amount you pay (generally month-to-month) in exchange for wellness insurance coverage. Cost-sharing describes the part of qualified health care expenditures the insurance firm pays and the section you pay out-of-pocket. Your out-of-pocket expenses might include deductibles, coinsurance, copayments as well as the complete cost of medical care services not covered by the strategy.This kind of wellness insurance has a high deductible that you have to meet before your health insurance coverage takes impact. These plans can be ideal for people that want to conserve cash with reduced month-to-month costs and don't plan to use their medical coverage extensively.

The downside to this sort of coverage is that it does not meet the minimal important coverage required by the Affordable Care Act, so you may additionally be subject to the tax obligation fine. Furthermore, temporary plans can exclude coverage for pre-existing problems (Commercial insurance in Dallas TX). Short-term insurance is non-renewable, and also does not include coverage for preventative treatment such as physicals, vaccines, dental, or vision.

Consult your very own tax, accounting, or lawful advisor rather of relying upon this short article as tax obligation, accountancy, or legal suggestions.

The Best Guide To Life Insurance In Dallas Tx

You should also provide anybody that occasionally drives your vehicle. While the policy only requires you to note "popular" drivers, insurance firms commonly interpret this term broadly, and some require that you list anyone who might utilize your automobile. Normally, vehicle drivers that have their own car insurance plan can be listed on your plan as "deferred drivers" at no extra charge.You can commonly "omit" any kind of home participant who does not drive your cars and truck, but in order to do so, you need to send an "exclusion type" to your insurance business. Vehicle drivers who only have a Student's Permit are not needed to be provided on your plan until they are completely certified.

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)

Health Insurance In Dallas Tx - Questions

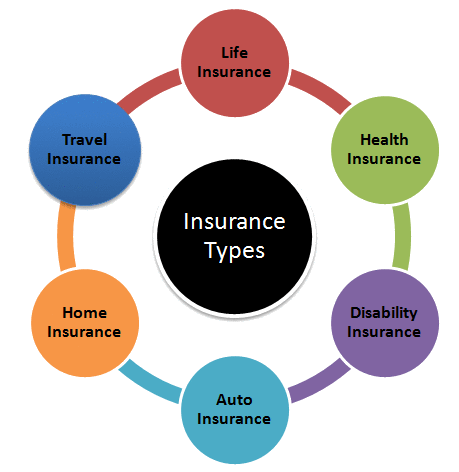

And also, as your life modifications (state, you get a brand-new task or have an infant) so should your insurance coverage. Listed below, we've explained briefly which insurance policy coverage you should highly think about purchasing at every stage of life. Keep in mind that while the policies below are organized by age, naturally they aren't all established in stone.Below's a short overview of the plans you need and also when you need them: The majority of Americans require insurance to manage healthcare. Picking the strategy that's right for you might take some research study, yet it works as your initial line of defense versus medical financial debt, one of greatest sources of financial obligation amongst consumers in the United States.

In 49 of the 50 US states, chauffeurs are called for to have auto insurance coverage to cover any prospective residential property damages as well as bodily harm that might arise from an accident. Auto insurance coverage prices are largely based on age, credit history, auto make and design, driving document and location. Some states even take into consideration sex.

When you stop leasing. Special needs insurance policy is implied to supply revenue should you be disabled as well as not able to function. It's approximated by the Social Safety And Security Administration that over 25% these days's pop over here 20-year-olds will certainly be impaired prior to retired life. If you're depending on a stable paycheck to support yourself or your household, you must have handicap insurance policy.

The Definitive Guide to Truck Insurance In Dallas Tx

An insurer will consider your residence's location, in Visit Your URL addition to the dimension, age and develop of the residence to determine your insurance coverage costs. Residences in wildfire-, tornado- or hurricane-prone areas will certainly virtually always command higher costs. If you market your home and go back to leasing, or make various other living setups.

For people who are aging or impaired and also need aid with day-to-day living, whether in an assisted living facility or through hospice, long-lasting treatment insurance policy can help take on the inflated prices. This is the kind of thing individuals don't think regarding up until they obtain older and realize this may be a truth for them, yet obviously, as you get older you get a lot more pricey to insure.

Essentially, there are two kinds of life insurance plans visit site - either term or permanent plans or some combination of both. Life insurers offer various forms of term strategies and conventional life policies as well as "interest sensitive" products which have become more prevalent given that the 1980's. Truck insurance in Dallas TX.

Term insurance policy provides security for a specified duration of time - Health insurance in Dallas TX. This period can be as short as one year or provide insurance coverage for a certain number of years such as 5, 10, two decades or to a defined age such as 80 or in many cases up to the earliest age in the life insurance policy mortality tables.

Our Insurance Agency In Dallas Tx Diaries

Report this wiki page